Signs of Investment Fraud

It’s up to the individual to spot and avoid the Signs of Investment Fraud Americans are losing billions thanks to brokers who forego ethics in the pursuit of their own financial gain. The Securities and Exchange Commission has stepped in with new regulations to stop this from happening, but where the SEC tries, it doesn’t […]

Red Flags of Alternative Investment Fraud

Investment fraud is designed to be hard to distinguish from genuine opportunities and are disguised in a multitude of different ways. The scam will have a combination of genuine features mixed in. This is done to throw you off the scent of a scam at first glance. Stock market fraud and Ponzi schemes are known […]

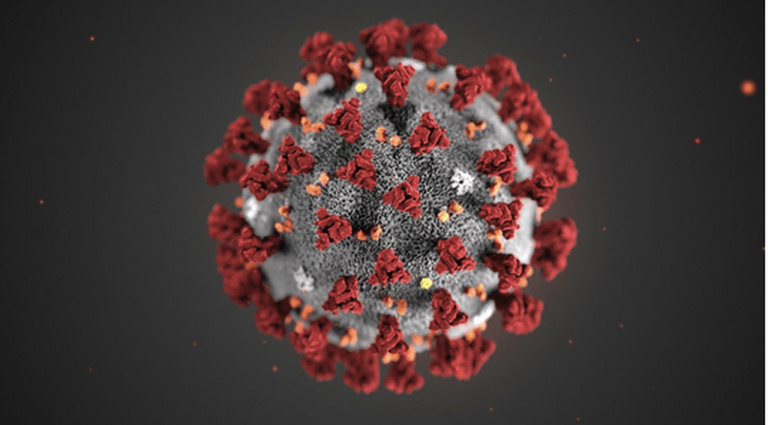

U.S. Attorney Warns of COVID-19 Scams

U.S. Attorney Warns of Coronavirus Schemes Targeting Vulnerable Victims ALEXANDRIA, Va. –U.S. Attorney G. Zachary Terwilliger Warns of COVID-19 Schemes seeking to exploit the evolving COVID-19 public health crisis by targeting populations most at risk of severe illness. “Fraudsters frequently prey upon vulnerable individuals during difficult times,” said Terwilliger. “The COVID-19 pandemic is a public […]

What’s a Reg A+ Investment?

What is a Reg A+ Investment Offering? Reg A+ of Title IV of the JOBS Act s a type of offering which allows private companies to raise up to $50 Million from the public in a 12 month period. Like an IPO, Reg A+ allows companies to offer shares to the general public and not just accredited investors […]

Self Directed IRAs and Due Diligence

Many Investors Falsely Assume their Self Directed IRA Custodian is Required to Conduct Due Diligence Investigations Investment research is NOT the function of an IRA custodian. The responsibility for researching alternative investments lies with the individual account holder, and performing due diligence properly can mean the difference between investment success or a complete financial loss. […]