Signs of Investment Fraud

It’s up to the individual to spot and avoid the Signs of Investment Fraud Americans are losing billions thanks to brokers who forego ethics in the pursuit of their own financial gain. The Securities and Exchange Commission has stepped in with new regulations to stop this from happening, but where the SEC tries, it doesn’t […]

Red Flags of Alternative Investment Fraud

Investment fraud is designed to be hard to distinguish from genuine opportunities and are disguised in a multitude of different ways. The scam will have a combination of genuine features mixed in. This is done to throw you off the scent of a scam at first glance. Stock market fraud and Ponzi schemes are known […]

SPECIAL OFFER FOR MAY – RISK REPORTS 50% OFF – NOW ONLY $250!

SPECIAL OFFER FOR MAY – RISK REPORTS 50% OFF – NOW ONLY $250! Risk Reports were developed in collaboration with professionals in banking, finance, insurance, and healthcare. These industries have thresholds intended to minimize fraud, waste, and abuse when investigating whether to conduct business with a prospective entity. We deliver dossiers on individuals and or […]

Troubled Brokers Sometimes Pitch Dangerous Deals

Due Diligence is an essential part of any risky investment. Higher risks offer higher rewards, but market volatility is already enough to worry about, that stress shouldn’t be compounded by an incompetent or unethical broker using your money for dubious purposes. Bad actors, rotten eggs, troubled brokers, whatever you want to call them—they should be […]

Misleading Prospectuses Are a Widespread Problem for Investment Fraud Protection Professionals

Prospectuses are required before a stock, bond or mutual fund is made publicly available for trade. Reviewing the document thoroughly is an important part of investment fraud protection. It is a formal communications document containing information about expenses, gains, losses, holdings, business objectives and more. Fundamentally, it is a guide to help you assess risk, […]

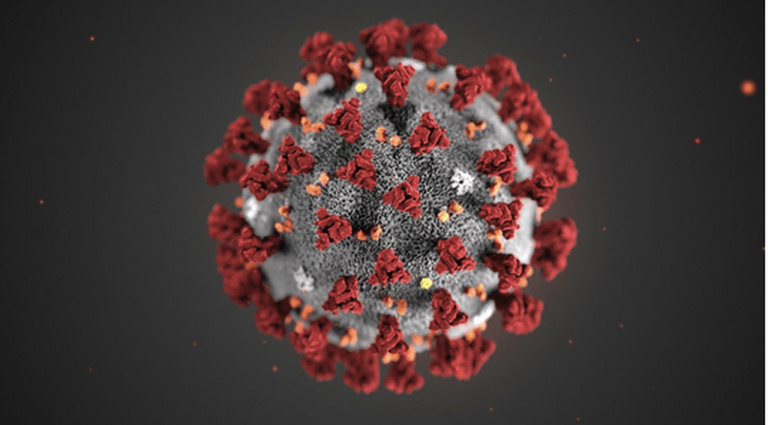

SEC Investor Alert – Look Out for Coronavirus Related Investment Scams

The SEC’s Office of Investor Education and Advocacy is issuing this Investor Alert to warn investors about investment frauds involving claims that a company’s products or services will be used to help stop the coronavirus outbreak. Fraudsters often use the latest news developments to lure investors into scams. We have become aware of a number […]

Oil and Gas Scams: Common Red Flags and Steps You Can Take to Protect Yourself

If you think you’ve found the right oil or gas investment to “strike it rich,” consider this: it may be a scam. While some oil and gas investment opportunities are legitimate, many oil and gas ventures are frauds. Many of these schemes start in so-called “boiler rooms,” where skilled telemarketers use high-pressure sales tactics to […]

U.S. Attorney Warns of COVID-19 Scams

U.S. Attorney Warns of Coronavirus Schemes Targeting Vulnerable Victims ALEXANDRIA, Va. –U.S. Attorney G. Zachary Terwilliger Warns of COVID-19 Schemes seeking to exploit the evolving COVID-19 public health crisis by targeting populations most at risk of severe illness. “Fraudsters frequently prey upon vulnerable individuals during difficult times,” said Terwilliger. “The COVID-19 pandemic is a public […]

Don’t make investment decisions based upon phone calls alone

The phone rings and a well-spoken gentleman asks if you have a moment to discover how to make a guaranteed 30% annual ROI on your money by investing in a new cutting edge technology. This is nothing new for you, as you except several investment calls a week. Although a guarantee of 30% return on […]

REGULATION D, PRIVATE PLACEMENTS

Rule 501 created the Accredited Investor definition for Investor eligibility for Rule 505 and Rule 506 Regulation D Private Placements. The Accredited Investor definition includes high net worth individuals whose income exceeds either $200,000/year (for single persons) or $300,000/year (for married couples) or a net worth exceeding $1,000,000 (excluding the value of their principal residence). […]